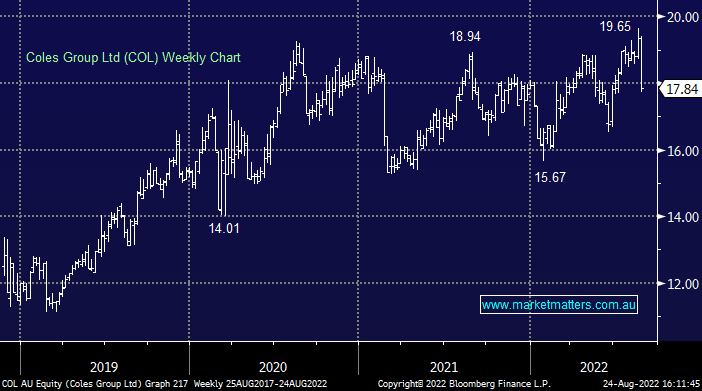

COL -4.60%: shares in the supermarket giant fell to 6-week lows today on soft outlook commentary. FY22 Net Income was $1.05b, up 4% and a slight beat to expectations, paying a 30c final dividend, largely as expected. The beat was driven by the core supermarkets business whereas Liquor and Express saw EBIT falls of 1.2% and 37.3% respectively. While no specific guidance was provided, the company talked about continued inflation pressure, particularly in wages, supply chain, weather impacts and energy. They will also be cycling strong sales seen in lockdowns this time last year so expect to see lower sales year on year early in FY23.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral COL

Add To Hit List

Related Q&A

Are Coles and Woolworths relatively safe investments?

What does feel about the “Insiders” Coles trading in Coles (COL)?

Does MM like Woolies & / or Coles

Is it time to buy Coles (COL)?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.