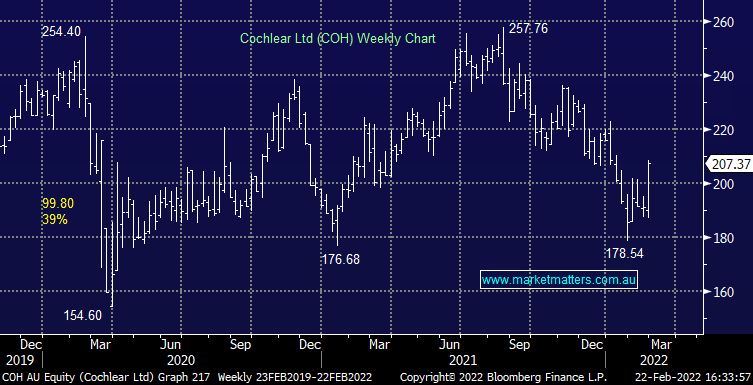

COH +9%: A stronger than expected sect of 1H22 results from the hearing implant company today driving the share price sharply higher. While there has been intermittent restrictions impacting operating conditions around the world, Cochlear have still managed to grow both revenue and margins, particularly in developed markets, with a surprise fall in operating expenses. Guidance was maintained for the full year, looking for net profit of $265-285m however it now includes COVID costs and cloud computing expenses, so really around a 5% increase to what the market had pencilled in.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

Related Q&A

Shares COHLEAR , SILVER MINES LIMITED, VYSARN LIMITED

COH and Emerging Companies portfolio performance

Cochlear (COH)

What are MM’s favoured recession proof Healthcare stocks?

MVF, COH, MQG & TWE

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.