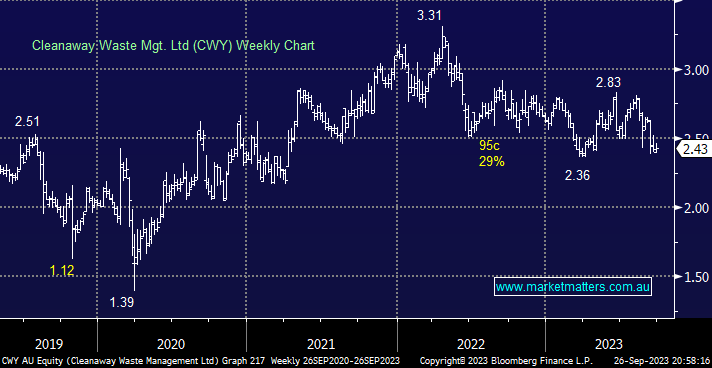

The waste management company has been struggling since they reported FY23 results in August that were solid/in line with expectations. The issue was they put off providing a trading update and guidance until their AGM on the 20th of October, and we all know how markets hate uncertainty. The market has clearly interpreted this as a sign of potential weakness and sold the stock down accordingly. In their AGM notice last week, they released details about executive long-term incentives, which effectively show that incentives kick in when the company meets its stated long-term growth forecasts, which are for earnings (EBIT) to be $500m by FY26. If they achieve these numbers, CWY will have grown earnings per share (EPS) at a ~20% clip between now and then, which implies they should be trading nearer $3, importantly, management incentives are aligned with this – which we like.

CWY has had some challenges, with labour availability being a big one, a headwind which has impacted many companies we follow. However, there are signs these pressures are easing, and given the medium-term tailwinds around waste management, recycling and a greener world, coupled with the very high barriers of entry into this market, we continue to like CWY, we just need some patience!

- We plan to wait until the AGM on the 20th of October before assessing whether or not to add, or indeed exit, our existing 5% position in the Flagship Growth Portfolio.

Our CWY position in our Flagship Growth Portfolio is currently showing a frustrating -9% paper loss, and as we believe at MM, focusing on our losers is the best way to add long-term alpha to a portfolio. In the case of CWY, when we look at its relative performance against the ASX post-COVID, it has simply backed off slightly before the October AGM, assuming we aren’t about to receive a hand grenade from left field, the move makes total sense. From a valuation perspective, CWY’s P/E is back to 28.6x versus a 5-year average of 28.8x and a high of 35.3x, in other words, the market has removed its optimism ahead of the AGM.

- We see no reason to sell our CWY position at this stage.