Bank earnings are now underway in the US and Citi was the standout overnight, beating on most metrics and providing solid/inline guidance for the full year:

- 2Q revenue of $US21.67bn relative to expectations of $US20.95

- 2Q Earnings per share (EPS) of $US1.96 beat $US1.60 expected

- FY25 guidance of about $US84bn was in line with prior expectations.

The result was driven mostly by a solid performance in their markets facing business, with fixed income traders doing particularly well. This builds on a solid result at their last quarterly update and provides evidence that the restructuring to improve returns is working. CEO Jane Fraser has been on a mission to improve the banks returns – the average large US bank is generating around 12% return on equity (ROE) while Citi has been struggling with an ROE sub 6%. Fraser has pushed through a massive reorganisation of the group over the past year, stripping out layers of management, selling off unwanted businesses and simplifying the organisation, and this is driving an improvement in returns.

To that end, return on average equity of 7.7% was a decent beat to expectations for 6.35%, and while this is still a long way below sector leader JP Morgan (JPM US), which reported ROE of 18% overnight, it’s trending in the right way, and implies there is still a long runway for improvement. For context, CBA’s ROE comfortably sits in the 13-14% range against average ROE for the Australian banks of 9-10%.

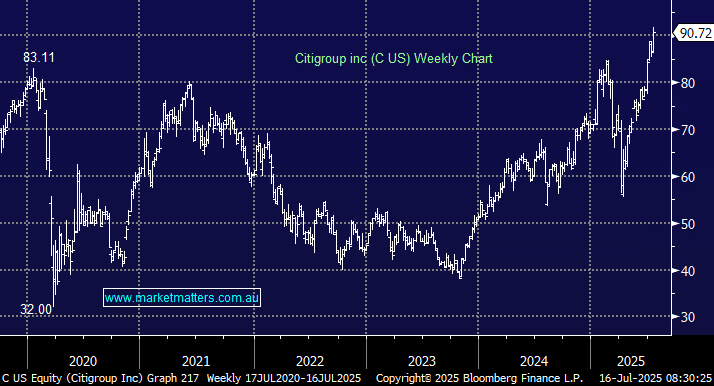

- C US pushed to new all-time highs overnight and is up 35% over the past year. While it’s had a good run, it’s still trading on 10.8x earnings, a 12% discount to the sector and 0.8x price to book, which is a 39% discount to the sector average. These discounts have been justified historically; however, we’ve now seen back-to-back results showing solid improvement in their financial metrics, and we’d expect Citi to remain supported as long as these trends continue.

We own Goldman’s which is also trading at all-time highs and is up 48% over the past year – with GS US reporting tonight, we’ll make a call post results on which bank is best placed from here.