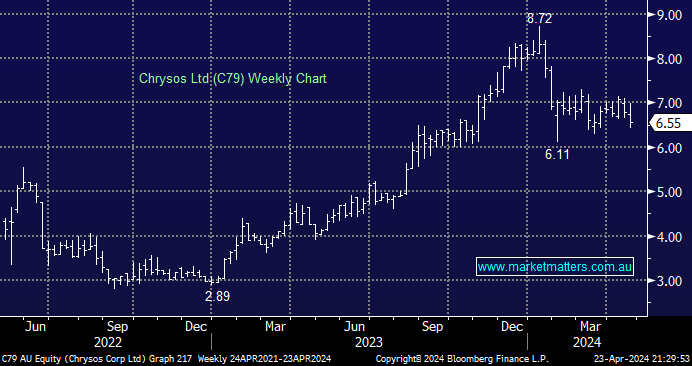

Shares in the mining technology company fell yesterday after a softer-than-expected 3Q update. Chrysos, the company developing the CSIRO Photon Assay technology, said 3 units were deployed in the period, and while this was an increase on the 2 units in 2Q, they are now expecting to fall short of their FY24 targets. Contract units hit 50; however, revenue guidance was lowered from $48-50m down to $48m. Encouragingly, earnings seem to be holding up ok despite the revenue slowdown. EBITDA is expected to be $8.5m in FY24 now, still inside the $7-17m guidance range previously provided. Cash burn on an operating level of just $700k in the period is also a positive, the company look poised to move towards positive cash flow, potentially in FY25.

While the update was disappointing, and we expect the share price to soften today following on from yesterday’s weakness, there are plenty of encouraging signs for Chrysos. The company’s PhontonAssay uses X-rays to analyse gold, copper, silver and other elements in mineral samples in a more accurate, timely and cost-efficient manner, all without destroying the sample, unlike traditional blast furnace technology. Samples processed increased 29% compared to 3Q23, and revenue on deployed units was running at $1.7m/unit as a result, up from $1.5m in the first and second quarters. The company has several deals in play, including with global gold giant Barrick Gold (GOLD US) and we expect to see deployed units continue to climb over the next few years.

Weakness in one quarter hasn’t impacted our long-term view of Chrysos. We currently hold a 4% weighting, sitting on a small ~2% paper loss. We would consider adding to this position if the weakness extends.