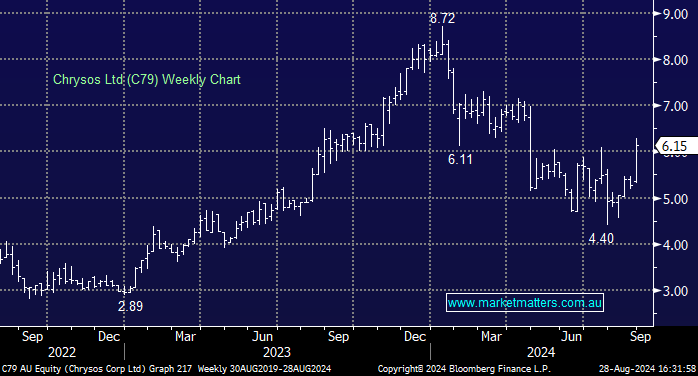

C79 +5.13%: Reported FY24 results on the 27th August that were a slight beat to expectations and the revised guidance they had recently issued.

- FY24 EBITDA of $9m which compared favourably to $8.5m expected

- Better margins were the main driver, with EBITDA margins up to 20.3% from 13.1% in FY23

- As the business scales, margins should improve, and we’ve seen evidence of this happening at this result.

Management reiterated the revenue and EBITDA guidance ranges set at the June 2024 quarterly update, which was for FY25 revenue of $60-70m and EBITDA of $9-19m. This implies modest growth in earnings for FY25, before we expect a step change in FY26 as the deployment of machines ramps up, building on the earnings from the existing machines already operating in the field.

- Gold markets remain strong, and for now, the backdrop for their CSIRO Photon Assay technology remains solid, albeit, coming off an underwhelming FY24 where deployments trailed expectations.