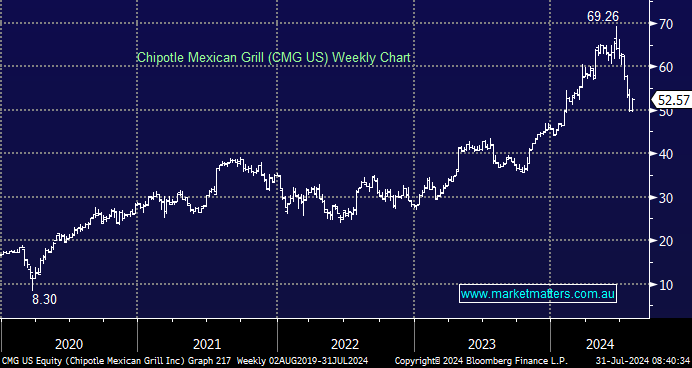

The popular Mexican fast food chain recently underwent a share split and has now fallen from $US69 in June, back to ~$US50 this week, with recent quarterly earnings being the primary catalyst. Their quarterly numbers were ahead of expectations, with strong sales for the period and impressive guidance for the top line (i.e. sales remain strong), while they also announced a $US400m share buy-back – all good news; however, cost pressures are building and were highlighted through a cut to Q3 margin guidance, which is where the market has focussed.

For Q2, sales of $US2.97bn mildly beat the consensus of $2.94bn, with adjusted EPS at 34c, which was 6% ahead of expectations. Margins were solid in the period, with the restaurant margin of 28.9%, though they have guided to deterioration here in Q3, forecasting a drop to 25%. They are generally conservative (and usually beat); however, cost pressures are coming through, led by a ~6% rise in wage costs and rising food prices (Avocado’s an issue), while they are also increasing portion sizes, which is amplifying the issue.

- Most analysts downgraded price targets on the back of the quarterly, hence the pullback in the share price i.e. Goldmans went from $74.6 to $67, Citi from $71 to $69, Oppenheimer from $70-$65. The consensus PT now sitting at $63.08 from 34 analysts that cover it, with 21 still having a buy.

We think the pullback in share price creates an opportunity to buy CMG US, and we remain long on our International Equities Portfolio