There is little doubt that Guzman y Gomez (GYG) has taken the mantle as this year’s hottest IPO on the ASX, set to list tomorrow (20th June) after raising $335.1m at $22/sh giving the company a valuation of ~$2.2bn. The shares will likely do well on the open given scarcity of stock and large-scale backs, however, it is a spicy valuation and there is a large amount of growth that needs to happen to justify that number – more on that shortly.

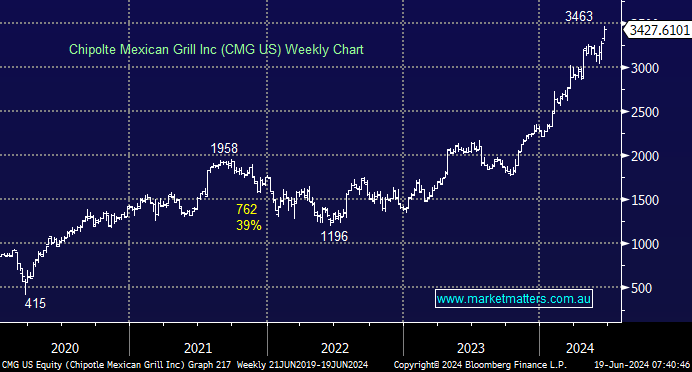

CMG in the US resides in our International Equities Portfolio and recently announced a 1 for 50 stock split which takes effect on the 26th June. CMG currently trades at $US3427.61, so come the 26th we’ll own 50x our current shares, at 1/50th the price, or $US68.55 based on the last close. CMG is a fantastic business, and the shares have more than doubled since we bought the stock in 2022. Clearly, GYG is hoping to replicate their success.

Firstly, we think the stock split is positive. Secondly, we continue to believe CMG is a great business executing well in a huge market, and we intend to keep hold of our position.

Some stats:

- CMG has nearly 3,500 stores, 100% of which are company-owned (no franchise model) with a target of 7,000 stores at a run rate of ~300 stores pa.

- GYG’s has 210 stores, primarily franchised (70%) with a target of 1000 stores in 20 years, putting it on a run rate of ~40 stores pa.

- CMG does sales of around A$15bn while GYG did $A780m last year, though only $340m comes back to the parent (given franchise model).

- GYG is growing sales at ~30% while CMG are growing around 15%, however, scale is the key to margins which will drive future earnings.

- GYG is not profitable so we’ll resort to a revenue multiple for comparison, with GYG shares sold in the IPO at 7x revenue while CMG trades on about 4.7x.

Both GYG and CMG are very similar businesses, and the success of CMG is no doubt one of the reasons why GYG has attracted so much interest. Since their IPO in 2007, CMG is up a huge 7000%!

- While we think the IPO will initially do well, we think the price is too high and we won’t be chasing the stock unless it comes back sub $20. Chipotle on the other hand, continues to be a core holding.

- We previously covered GYG here.