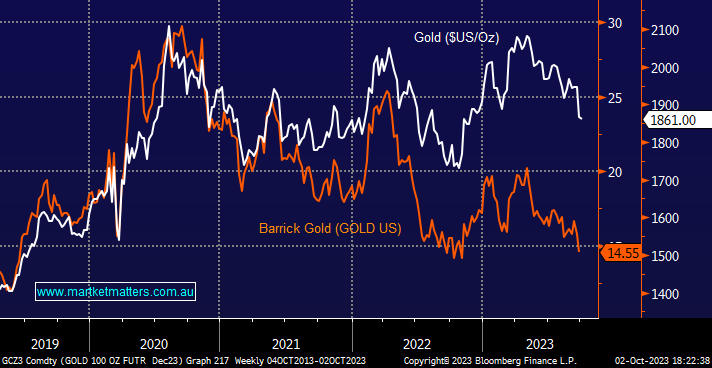

At times, we can get “leads” from stocks that related markets are poised to turn, a factor which is especially useful at major tops and bottoms, e.g. at a bottom, gold stocks often find buying even when precious metals continue to fall. This morning, we’ve looked at two topical commodities to see if any useful information is being conveyed.

- Overnight gold fell ~1% as yields and the $US rose, US heavyweight gold company Barrick Gold (GOLD US) also fell -2.2% – no turn suggested here.

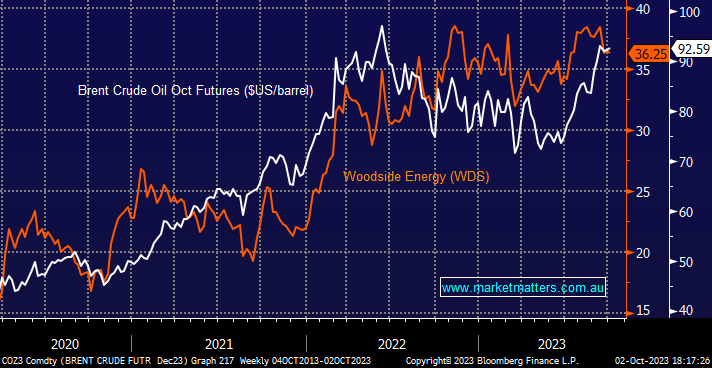

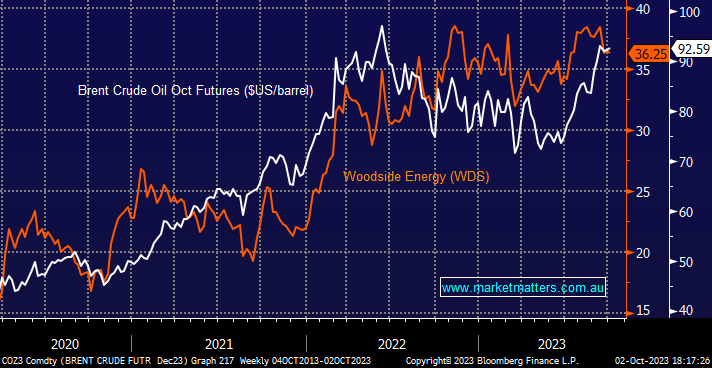

Woodside Energy (WDS) has struggled to match the oil prices’ gains over the recent weeks, a potentially worrying read-through that oil is “topping out” – after a quick 5% pullback, the question is now whether this move will continue or it will prove to be a short term “blip”.

- We still believe WDS is good value with oil ~$US90, but it’s vulnerable to increased recession fears and ongoing weakness across the energy complex.