Australian lithium stocks enjoyed a solid bounce last week, e.g., IGO Ltd (IGO) +11.4%, Pilbara Minerals (PLS) +10%, and Mineral Resources (MIN) +6.9%. We believe the sector will recover further, but it’s still an area where investors should adopt a very active approach due to so many uncertain variables still to play out, plus most stocks are already pricing in higher lithium prices over the years. Some supply has recently been curtailed, slowed or delayed, which is progress towards rebalancing, but we note it could be transitory if price sentiment lifts too fast – prices have bounced around 20% from their 2024 low.

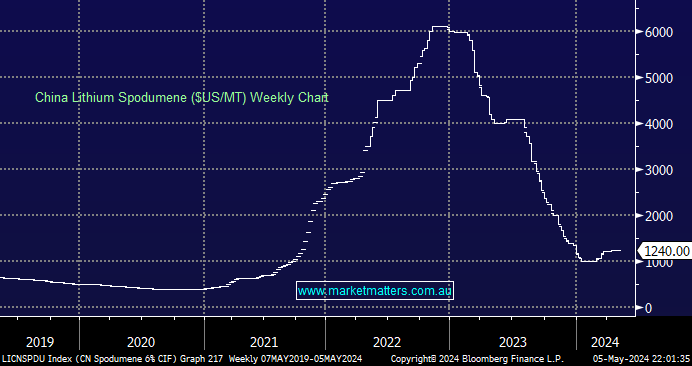

- We believe the lithium price is “looking for a low” after plunging over 80% from its 2022 high.