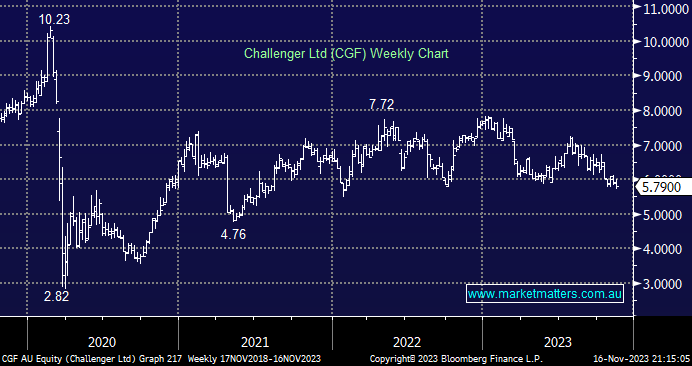

CGF slipped -2% on Thursday, posting fresh 52-week lows in the process, although the stocks traded sideways since mid-2021. While we would expect CGF to enjoy a favourable annuity sales backdrop based on the ability to offer customers higher returns (as yields have risen on the fixed income investments that underpin their annuity book), this wasn’t yet obvious in their 1Q24 sales update that showed book growth relatively flat on the quarter; the lacklustre share price reflected this performance.

We’ve always tended to be cautious about CGF given the complexity in their book that underpins their annuity liabilities, not the mention the backdrop of an aging population.

- We see no reason to second guess when CGF will break out of its 2.5-year trading range.