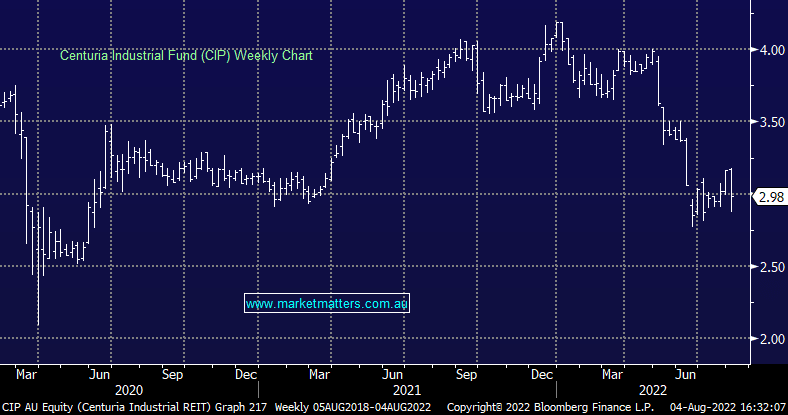

CIP +3.83%: This week we saw a downgrade from Centuria Office REIT (COF) which dragged down Centuria Capital (CNI) in the process, given their 17% holding. Today the Industrial focissed CIP reported full-year earnings that were a touch above expectations, Funds From Operations (FFO) $111.7 million up +22% yoy and ahead of consensus of $110.5 million – on a per unit basis this was $0.182 versus 0.18 expected while the dividend was solid at $0.1730. Total assets jumped by a third to $4.1 billion, reflecting $765 million in acquisitions during the year – a big year for them and this helped to push their Net Tangible Assets up 11% to $4.24 per unit, while their shares were down 28%. There is clearly a lot of bad news baked into this particular cake and while earnings will be lower in FY23, with FFO guidance of $0.17 and a dividend of $0.16, we think the share price has now factored in more than enough pain. NB: CNI which we recently bought in the Income Portfolio owns 14% of CIP.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes CIP around $3

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.