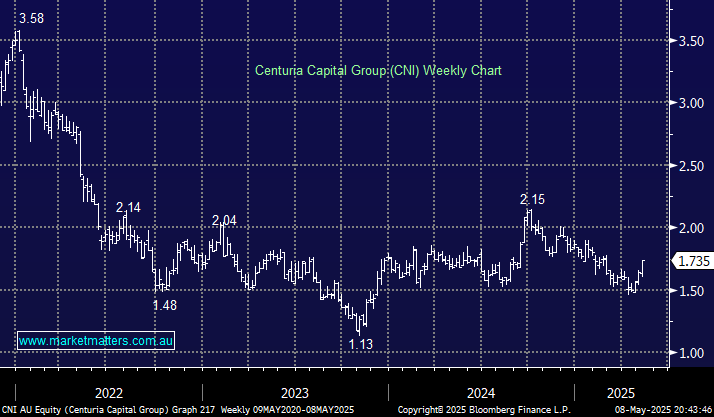

This real estate funds manager has been relatively lacklustre this year after CNI disappointed the market when they reported in February. They now offer great risk/reward to bottoming valuations in commercial real estate, aided by the migration away from WFH, which will flow into an uplift in transaction fees. CNI is also aiming to list two new REITS this year, aiding its diversification and improving its already steady and strong business.

- We like CNI for its growth, and attractive 6.5% yield: we hold CNI in our Active Income Portfolio and Emerging Companies Portfolio.