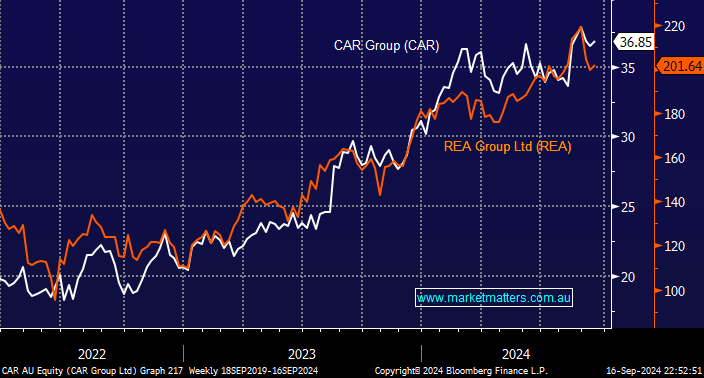

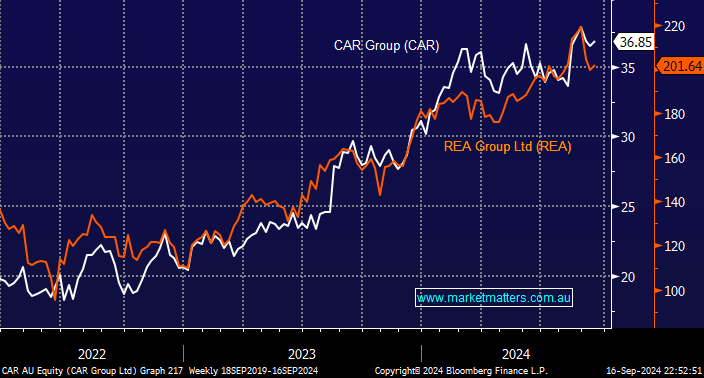

CAR and REA have performed strongly through 2024, gaining +18.3% and +12%, respectively. The primary reason CAR is currently outperforming is REA’s ~$11bn bid for UK-based Rightmove (RMV LN). As is the norm, the bid has already been rejected, and the market is now considering REA’s next move—the stock’s pulled back almost 12% since the announcement. We like REA as a company and its potential takeover of RMV, but it’s not exciting ~$200 considering the risks associated with a move into the UK – we will be interested in the $180-190 area.

- We like CAR and XRO but may consider a move from CAR to REA if the latter were to pull back another 7¬8%— MM owns CAR in our Active Growth Portfolio.