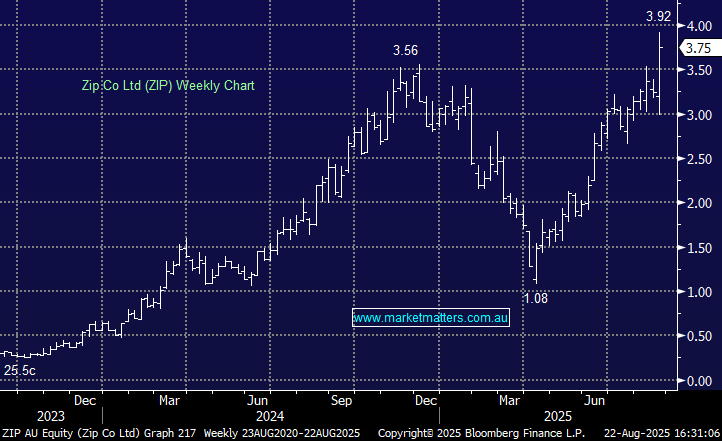

Yesterday, Morgan Stanley upgraded CAR, just a few days after Goldman. The stock surged early on Tuesday before encountering profit-taking as the market drifted lower, but it still closed up in a relatively weak market.

- Citi raised CAR to a BUY with a price target (PT) of $39.80, while Goldman was more bullish; their PT is now $41.50.

Goldman believes Australian vehicle classifieds provider CAR Group is well placed to maintain annual earnings growth of more than 10% despite currency and U.S. headwinds. They are looking for CAR to impose a 4%-5% price rise on dealers in September; as we’ve mentioned a few times, pricing power helps stocks maintain strong valuations – CAR is trading at a 17% premium to its last 5-years valuation, not uncommon in today’s strong market. Dealer margins remain strong, and if required, CAR can slow investment if earnings growth appears to be slowing. However, they also noted that dealer numbers and inventory at CAR’s U.S. Trader Interactive unit are being hit by macro weakness, while currency moves are a headwind to Brazil’s earnings.

- Pricing power is key; following a 5-6% increase in the private market, GS expect a 4-5% dealer increase in September.

- Local trends remain strong, most noticeably in used vehicles, plus healthy new car volumes support media revenues despite the challenging ad market.

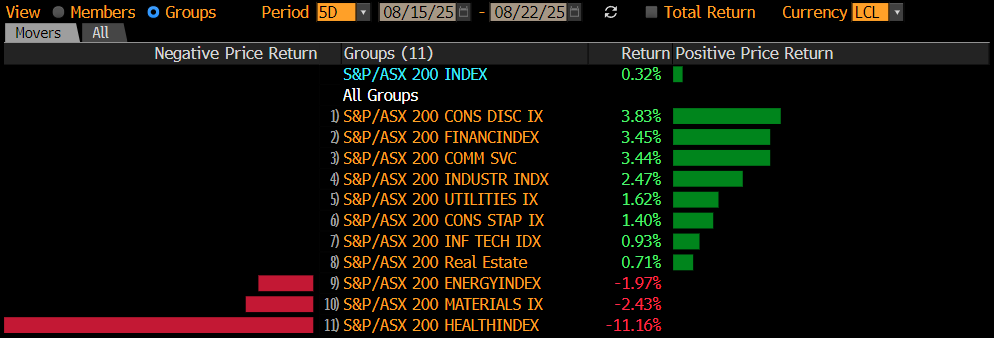

Our concern at MM is that CAR is highly correlated to the Tech Sector, which we believe will continue its recent underperformance into Christmas.

- We are targeting ~$40 for CAR over the coming weeks/months, still over 10% higher – MM is long CAR in our Active Growth Portfolio.