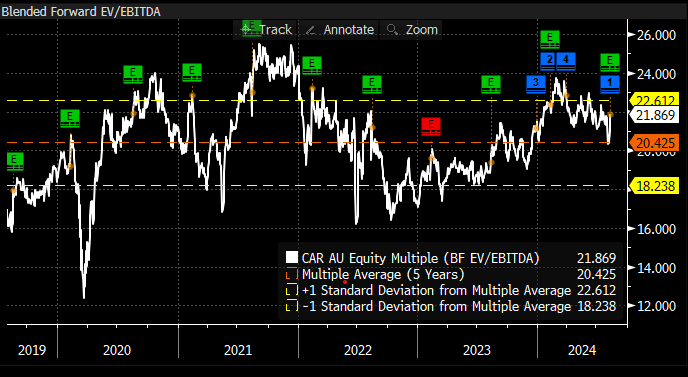

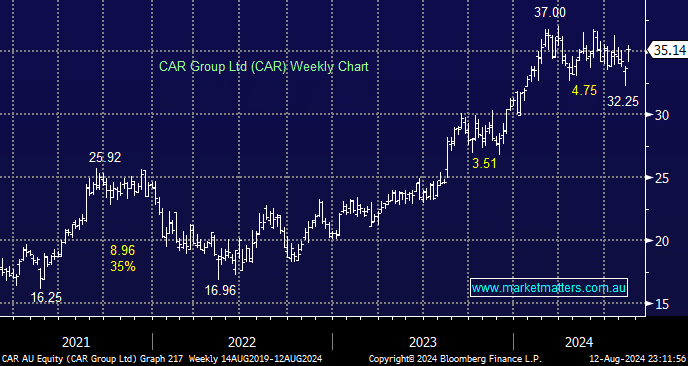

Following its solid/inline FY24 result on Monday, CAR rallied +4.5%; as we said yesterday, we believe their flagged outlook for ‘good growth’, which MM believes, could prove conservative. When we look at CAR’s relative valuation over the last five years, it may be on the expensive side of the ledger, but it’s nowhere near stretched, i.e. it was trading on a higher valuation earlier in 2024 and especially in 2021.

- The important thing to remember around valuation is they reply on both the P (price) & the E (earnings). An underappreciation of the E by the market can quickly bring a higher valuation back inline line, so, focussing on earnings and earnings revisions remains a core focus for MM.

A move back towards its higher valuation levels over recent years will bring our target area into play. Following yesterday’s result, we can see the market pushing CAR’s valuation back towards the 24x area as they continue to expand successfully overseas.

- We continue to target the $40 area for CAR, or ~15% higher – MM holds CAR Group (CAR) in our Active Growth Portfolio.