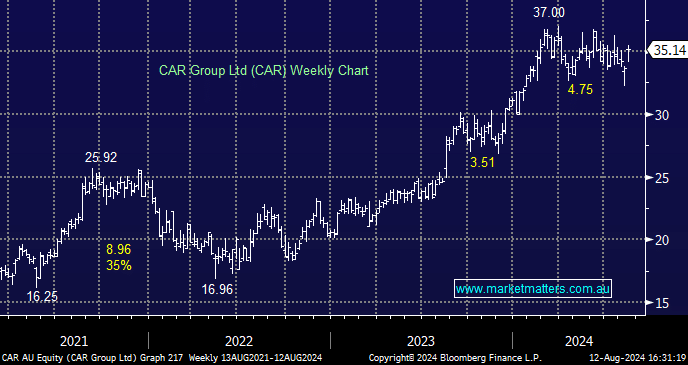

CAR +4.46%: A solid/inline FY24 result today, and while they stuck to their usual script around the outlook for ‘good growth’ we got the sense they could actually deliver ‘very good’ growth given how well the international businesses are doing, and the better outcome from the dealer network than feared in Australia.

- Revenue from continuing operations $1.1 billion, +41% y/y, estimate $1.1 billion

- Adjusted net income $344 million up +24% y/y, estimate $344.1 million

- Adjusted Ebitda $581 million, +37% y/y, estimate A580.5 million

- Final dividend per share A$0.385 vs. A$0.3250 y/y

The Australian business delivered 12% yoy revenue growth, with growth in the 2H24, mildly ahead of expectations. Looking at the recent fate of the car dealers (Eagers as example down ~60% from this year’s high), it’s understandable that the market was cautious on CAR, however, they’ve also guided for dealer growth stronger than expected, with international in-line, but slightly weaker EBITDA margins. Essentially, we read this as better top line growth offset by slightly weaker margins i.e. net/net neutral, which we think is a good outcome relative to market positioning.