Over the long weekend in the US, Cameco downgraded their 2023 production forecast given challenges at two of their mines. Overnight was the first time the stock had a chance to react and the response was muted, ending down just -0.56%. The initial news saw many in the sector rally strongly as fewer new pounds into the market constricts an already challenging environment for buyers, who seem to be increasingly focused on locking down supply which is shown through greater activity in the contract market.

The downgrade totalled 2.7m pounds of U3O8, however the reaction by the broader market was an interesting one. The muted decline from Cameco and the rally across other stocks in the sector clearly shows traders/investor’s view around the market, that any incremental change in the supply dynamics will have an immediate impact on price, which is only the case when markets are very tight.

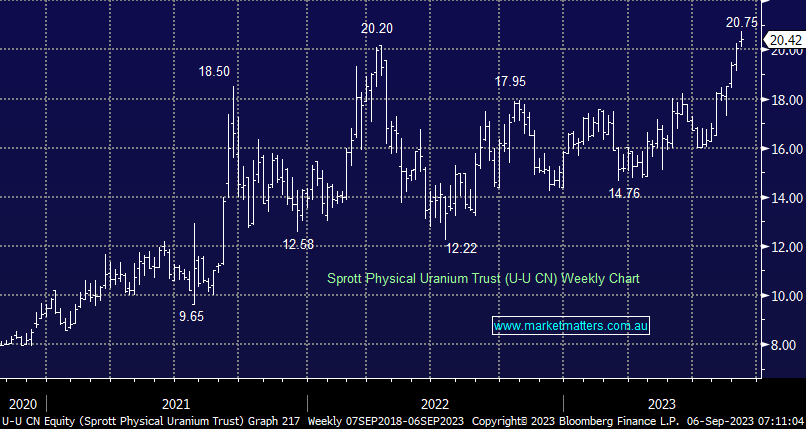

The Sprott Physical Uranium Trust (U-U CN) is worth keeping a close handle on, and longer-term readers will know we’ve written about this in the past. The trust, which holds physical Uranium, hit a new high this week which is another positive read-through for the sector generally.

We own Cameco (CCJ US) in the International Equities Portfolio, and Paladin (PDN) in both the Flagship Growth & Emerging Companies Portfolios. We are bullish over the medium to long term for Uranium and see it as a major beneficiary of the significant, multi-decade energy transition that is underway globally.