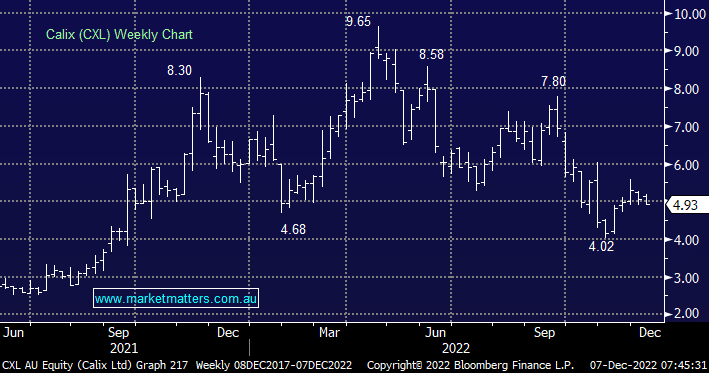

This is a stock that could do anything, and the loss of government grants has it down ~11% since we flagged it as a conviction buy. At the cutting edge of carbon reduction technology for industrial applications like cement production, Calix ‘should’ have a huge future, however, we are always cognisant that left-field events can hit companies that are big on storyline and light on earnings, particularly those with a market cap of ~$1bn like CXL. We originally bought CXL at $4.22 with a 4% portfolio weighting and continue to believe the stock is a buy, however, we caution on position size given the risks in the execution and commercialisation of their technology. MM has no intention of going above a 4% portfolio weighting.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish CXL <$5.00, although we have no intention of increasing our ~4% weighting

Add To Hit List

Related Q&A

CXL

Your current view regarding Calix (CXL) from a risk reward perspective.

Cutting losses in the Emerging Portfolio

CXL (CALIX LIMITED)

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

What’s happening with Calix (CXL) at the moment?

What are MM’s views on Bowen Coking Coal and Calix?

What does MM feel towards Calix (CXL) today?

What are MM’s view on CXL & CAN?

What are thoughts on Calix, IGL, SIQ and SUL?

What’s happening with Calix (CXL)?

Thoughts on the Banks & CXL

Calix update & a comment on SRG Global

Is Calix changing their thematics

WSA, ASM & am I too late to buy Calix (CXL)?

Is Calix the real deal or a green trap?

Thoughts on CRW & CXL

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.