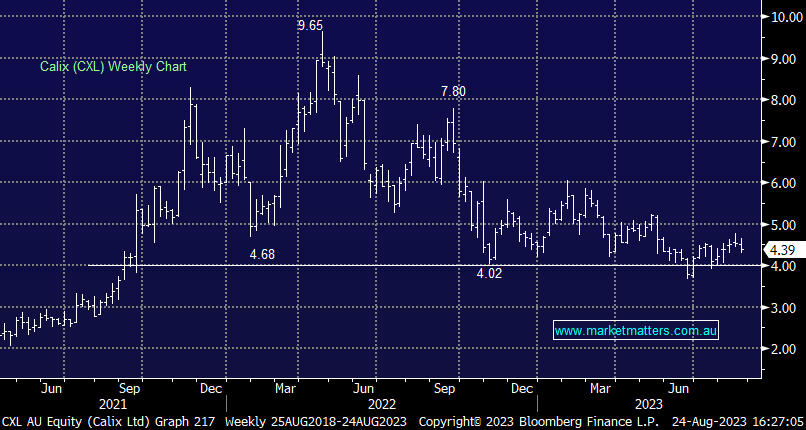

CXL -3.3%: FY23 results today show the progress Calix is making in commercializing a number of green industrial solutions, supported by a strong balance sheet as they come to market. Revenue was up 42% to $29.6m with margins up, driven by their water business. The opportunity is elsewhere though, mainly in cement & lime as well as chemical processing. They signed their first licence agreement for Leilac with a second project on the way and plenty of others in the pipeline. The company recently agreed to a deal with Pilbara Minerals (PLS) for a midstream lithium processing plant, supported by a $20m Australian Government grant while Pilbara will contribute an oversized share of the capex. The company has ~$75m in cash which supports further investment in new and existing projects as they start to commercialize the technology.

scroll

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is long and staying patient with CXL

Add To Hit List

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.