CXL +0.95%: today announced a relatively small $947,035 grant by the Australian Renewable Energy Agency (ARENA) to help fund a Basis of Design (BOD) and Front-End Engineering and Design (FEED) study for a renewably powered demonstration plant for its Zero Emissions Steel Technology (ZESTY). While that is clearly a mouthful, and the amount is a trickle in the ocean relative to their recent loss of ~$40m in grants following the budget (these could come back – maybe), we still view this as a positive outcome as it highlights the attractiveness of Calix’s technology, but also the willingness of the Australian Government to fund green projects.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

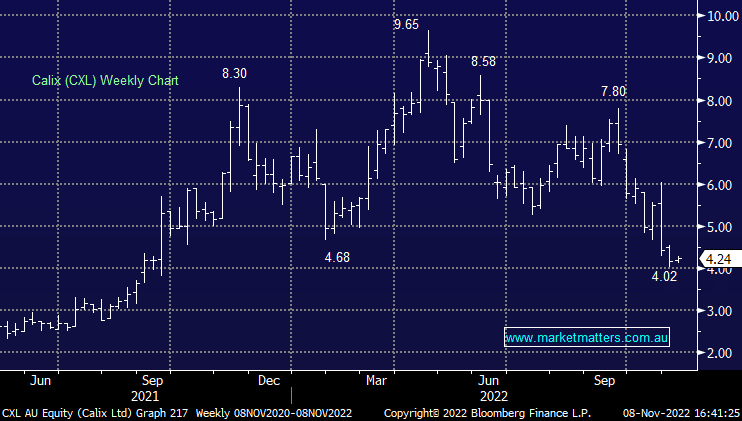

MM remains a long-term bull on CXL

Add To Hit List

Related Q&A

CXL

Your current view regarding Calix (CXL) from a risk reward perspective.

Cutting losses in the Emerging Portfolio

CXL (CALIX LIMITED)

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

What’s happening with Calix (CXL) at the moment?

What are MM’s views on Bowen Coking Coal and Calix?

What does MM feel towards Calix (CXL) today?

What are MM’s view on CXL & CAN?

What are thoughts on Calix, IGL, SIQ and SUL?

What’s happening with Calix (CXL)?

Thoughts on the Banks & CXL

Calix update & a comment on SRG Global

Is Calix changing their thematics

WSA, ASM & am I too late to buy Calix (CXL)?

Is Calix the real deal or a green trap?

Thoughts on CRW & CXL

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.