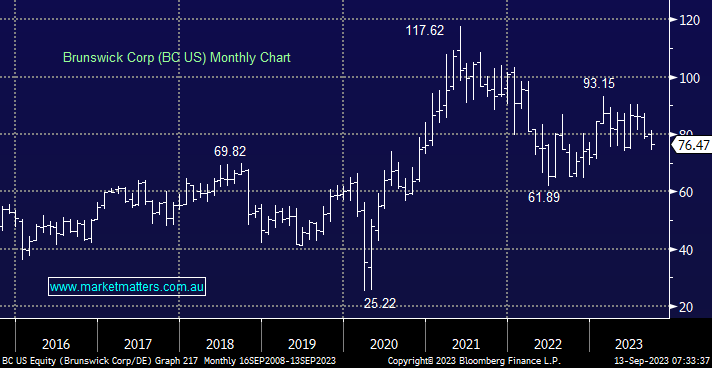

The International Equities Portfolio has 5 positions (from a total of 19) that are currently showing a loss, with the world’s largest consumer marine company behind brands such as Mercury, Boston Whaler & Sea Ray, one of those, down by ~17%. Last week JP Morgan wrote a note as they downgraded the stock from Overweight to Neutral, largely on macro concerns that they believe will inhibit growth over the coming year. We obviously focus a lot on the macroeconomic environment at MM, and for good reason. Large companies like Brunswick are heavily influenced by broader economic trends, more so than niche, smaller companies, and clearly the rise in interest rates has/will have an impact on the demand for recreational marine products.

JPM wrote…“We ultimately see BC’s business achieving Flat to Low-Single-Digit growth over the next 2 years on relatively Flat margins, with Free Cash Flow (FCF) conversation below management’s historical ~75% target.” They cut their price target from $109 to $79, which is around about current levels.

We would argue that this is not ‘new news’ and is already captured in the earnings multiple of 7.6x being applied to BC. This is historically very cheap compared to its average earnings multiple of 10.5x over the past 5 years which also included some huge variance through the COVID period. Initially, the stock was sold off to 5x earnings, before rallying to 18x as interest rates were cut, liquidity was pumped into the system, and people bought boasts instead of holidays.

- BC is hosting an investor day next week (18th Sep) and this will give us more insight into recent trends. We will await this update before making a more definitive call on the position.