- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

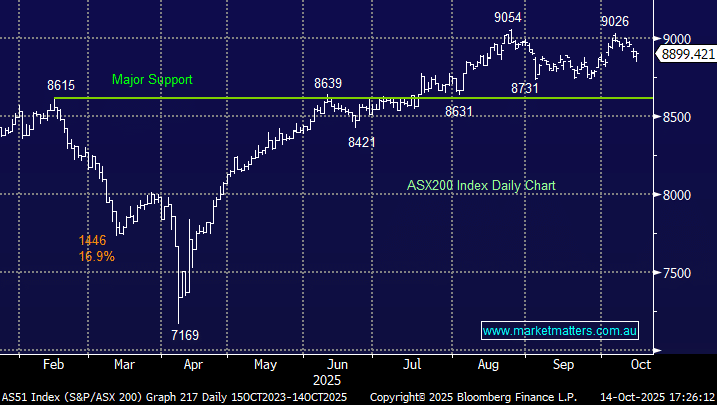

The ASX200 experienced a choppy Tuesday before ultimately closing up +0.2% courtesy of another stellar session by the resources, with the materials sector +2.3% and energy sector +1.4% dragging a begrudging market higher. Only five of the market’s 11 sectors finished up, but when resource names rally across the board, from uranium and coal to rare earths, lithium, gold, and copper, and even the heavyweight iron ore stocks join in, it creates a powerful bullish tailwind for the broader market.

However, while the miners enjoyed all of the headlines on Tuesday, some profit-taking came into several of the larger names, taking them off their intraday highs – no surprise with the materials sector significantly outperforming its peers over the last six months. What caught our attention elsewhere was some buying coming into the recently unloved tech sector during the session, while we are not game to say the likes of Xero (XRO) and WiseTech (WTC) have finished their pullback, they do appear to be “looking for a low” as we often say, but mixed performance from their peers in the US may dictate when it comes in.

Within minutes of the ASX closing yesterday, global stocks and futures fell away as China placed limits on five US entities tied to one of South Korea’s biggest shipbuilders and threatened further retaliation. We discussed on Tuesday that Beijing was likely to pull the strings in the current trade tussle, and yesterday’s move showed no indication that they’re in a hurry to sit down with President Trump. Volatility spread through risk assets, with copper, S&P 500 futures, crude oil and even bitcoin tumbling – the ASX would have painted a very different picture had we closed at 5pm.

Not surprisingly, overseas markets were volatile and mixed overnight, with tech the only laggard following a turnaround by stocks as they dismissed recent US-China trade issues as just short-term noise, and focussed on a likely interest rate cut at the end of the month. In Europe, the German DAX closed down 0.6% while the UK FTSE finished the day up +0.1%. In the US, the small-cap Russell 2000 outperformed, advancing +1.4% and the Dow advanced +0.4% but the tech-based NASDAQ closed down -0.7%.

- The ASX200 is set to open up around 0.8% this morning, helped by a ~70c advance by BHP in the US.