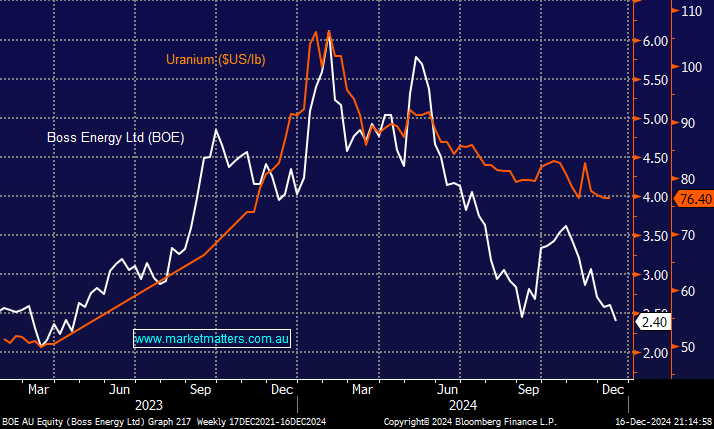

Investment bank UBS has lowered its outlook for uranium over the next two years by 9% to $US78 a pound in 2025 and 2026 and cut its share price target for Boss Energy (BOE) by 3% to $3.40. The uranium space is in a bearish downtrend at present, and this change sent BOE down a whopping 8%, way more than the downgrade and below UBS’s target for the South Australian producer. Ironically, they still have a Buy on BOE, believing the stock is oversold.

MM is not on an island with our bullish outlook towards uranium, although it’s not currently working! Morgan Stanley is forecasting the uranium spot price to rise to $US90 a pound by the second quarter of 2025. Bank of America is far more bullish; they expect the price of uranium to surge more than 50% from current levels to $US120 a pound next year and to rise to $US135 a pound in 2026 and $US140 a pound in 2027 – as the saying goes, that’s what makes a market!

- We like the risk/reward toward BOE into a “washout” new 2024 low below $2.30.