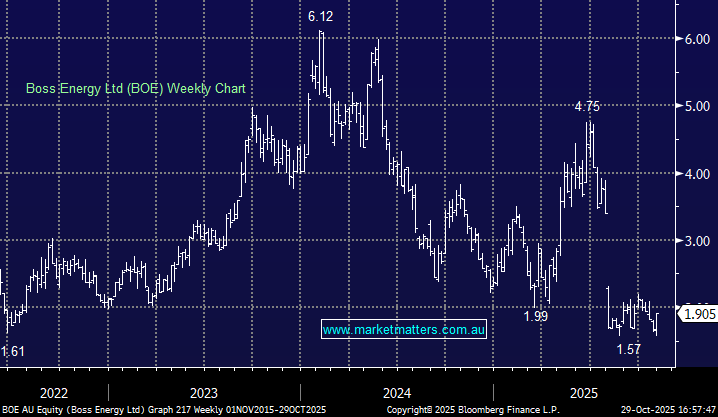

BOE +19.8%: The recent struggles of the Australian uranium producer were put to one side today as shares jumped on the positive news from Cameco + they also released a solid quarterly update.

The broader sector move came after Cameco (CCJ) soared 24% overnight on news of an US$80bn U.S. government partnership to develop new nuclear reactors through its 49% stake in Westinghouse Electric, with U.S. federal financing and permitting support driving renewed optimism across the nuclear supply chain.

The quarterly production numbers were solid and led to outperformance relative to the broader uranium sector today:

- Production: 385,910 lbs uranium (+11% QoQ)

- Sales: 400,000 lbs (+400% QoQ)

- FY26 AISC Guidance: $64–70/lb (unchanged)

While the uranium sector’s renewed momentum provided a welcome backdrop, Boss Energy’s quarterly update itself showed steady operational improvement and highlighted demand for uranium in its big jump in quarterly sales. Still, the market has a short memory when it comes to the extraction and cost challenges that blindsided investors in July, and the pending independent review remains the key catalyst – now due in December.

If the review isn’t “too bad,” the upside could be sharp, as investors continue to rotate into uranium names on the back of the nuclear energy revival. For now, BOE’s rebound feels more sentiment-driven than structural, and we’ll need to see clarity on long-term extraction costs before confidence returns.