The worlds largest alternative asset manager reported very strong 2Q earnings last night, ~9% ahead of expectations with the stock rallying 3.6%.

- Total segment revenue $US3.07 billion, +22% y/y, estimate $2.83 billion

- Fee-related earnings $US1.46 billion, +31% y/y, estimate $1.34 billion

- Fee-related earnings per share $US1.19 vs. 91c y/y, estimate $1.10

The reported net flows of $US41bn and have dry powder for investments of $US181.2bn. Total assets under management increased 13% year on year to $US1.21 trillion, slightly ahead of expectations. Interestingly, the US is paving the way for 401k’s, which is their employer-sponsored retirement savings system, to move into alternative assets, broadening from just traditional stocks and bonds. BX are in a great position to benefit from such a move.

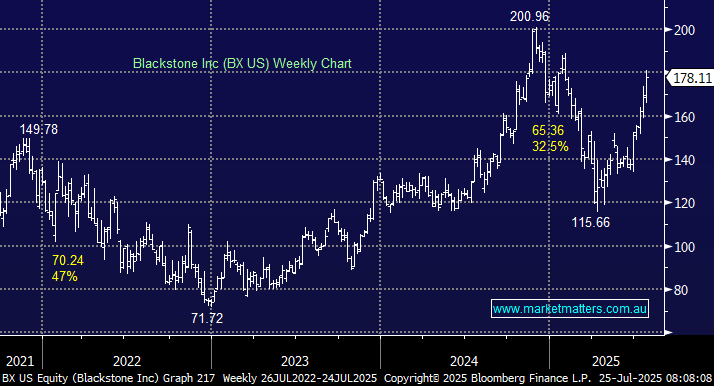

- Like Microsoft in the tech space, we view Blackstone as a core holding in the International Equities Portfolio.