This major ASX-traded global energy ETF allows investors to gain exposure to the international energy names, tracking the NASDAQ Global ex-Australia Energy Companies, currency hedged. This ETF currently has 51% in US companies, followed by 17% in Canada, 12% in the UK, and 7% in France. The ETF has 45 current holdings headed by well-known Exxon, Shell and Chevron. We believe the ETF represents good value, with costs at 0.57% pa while providing exposure to a diversified basket of global energy stocks.

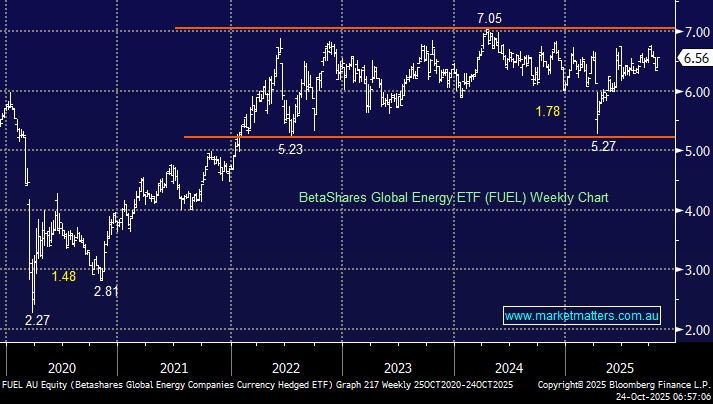

- We like the FUEL ETF for simple ASX-traded exposure to global energy, but it needs ongoing bullish news to break out of its multi-year trading range.

However, the FUEL ETF costs money to hold and delivers an uncertain, unfranked yield. For investors who want to start positioning themselves for a turn in oil prices, Woodside (WDS) would get our vote. It’s highly correlated and pays an attractive fully franked yield and has been in the news for the right reasons over recent days. WDS partnered with Williams to sell a 10% stake in its Louisiana LNG project and transfer 80% ownership of the Driftwood pipeline, securing $2.3 billion in upfront and construction funding. Importantly, they raised their FY25 production forecast to 192–197 mmboe, driven by strong performance at Sangomar, Pluto LNG, and North West Shelf projects.