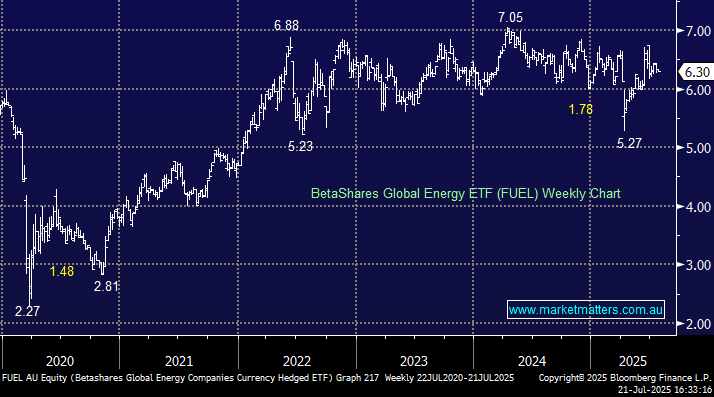

ASX-traded FUEL ETF tracks the NASDAQ global ex-Australia Energy Companies currency hedged Index for a cost of 0.57% pa. The ETF currently carries exposure of 57% US, 13% Canada, 12% UK, 6% France across 48 holdings. The largest five positions are Chevron Corp 8.4%, Exxon Mobil 8.2%, Shell PLC 8%, TotalEnergies SE 6.5% and ConocoPhillips 5.9%. This ETF tracks its benchmark well, over the last 3 years it has gained +8.9% while the index has gained +8.7% making it an excellent vehicle for exposure to the global oil and gas sector. The ETF has been rotating between $5 and $7 for the last three years with test of the upside looking probable, but when is a tougher call.

- We can see the FUEL ETF testing above $7 in 2025, around 10 to 15% higher.