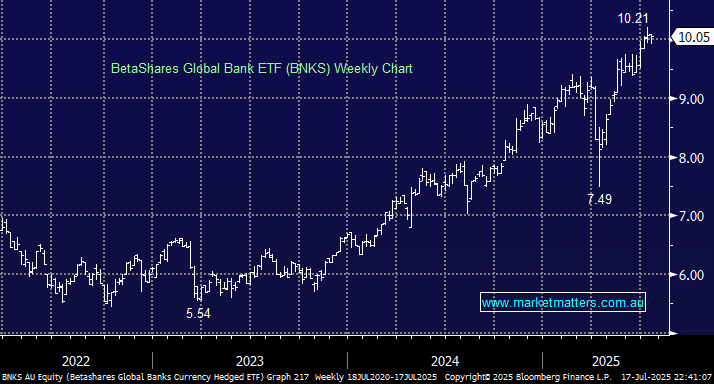

The BNKS ETF seeks to track the return of the Nasdaq Global ex-Australia Banks Hedged Index (before fees and expenses), which provides exposure to a portfolio of major global banks with the focus of its current global footprint being 33% in the US, 14% in Canada, 10% in the UK, 8% in Japan, and 6% in Spain.

Of the 78 stocks held, the five largest positions are JP Morgan 8.2%, Bank of America 7.9%, Wells Fargo 6.1%, Royal Bank of Canada 4.7%, and HSBC 4.4% – an excellent mix of global banks.

- The BNKS ETF charges 0.57% which is okay considering its international mix, and it tracks its benchmark very well; for example, over the last 3 years, the BNKS has advanced by 24.65% while the Nasdaq ex-Australia Bank Index has gained 23.8%.

BNKS looks set to extend its recent gains as the US banks report strongly, although its forecasted 3.4%, non-franked yield, isn’t as attractive as the local names.

- We are bullish on the BNKS ETF, initially targeting new highs in line with our bullish but choppy outlook into Christmas.