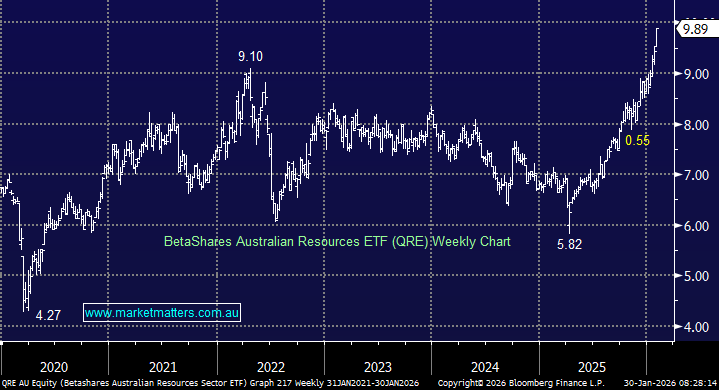

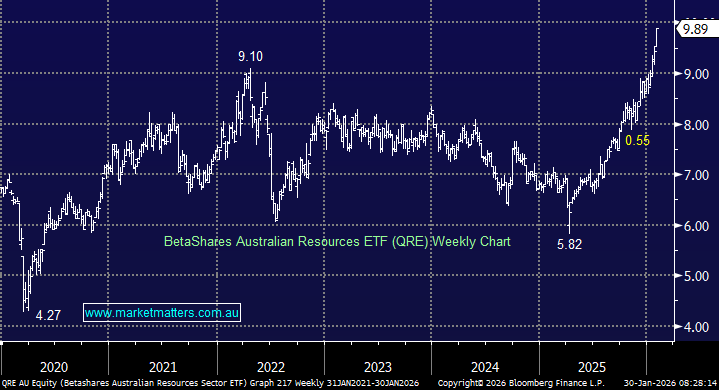

This QRE is made up of all the likely names, although ~11% is oil & gas, but this hasn’t managed to rein in the ETF’s stellar performance since April 2024, helped by gold and copper stocks exerting an increasing influence as they surge ever higher. At this stage of the cycle, we see no reason to fight the trend, believing the ETF can add to its +70% advance, but if we are correct around gold, for example, some consolidation is likely in this FY.

- We can see the QRE ETF consolidating around $10 before punching higher through 2026.