The QRE ETF aims to track the ASX200’s Resources index. Of forty-seven stocks held, the largest five holdings are BHP 35.5%, WDS 9.1%, RIO 8.1%, NST 5.4%, and FMG 5.1% and with plenty of smaller positions in the mix, but notably around half are in iron ore facing stocks. From a sector perspective, its main positions are 71% in mining and 16% in oil & gas. To use the QRE ETF, investors looking to gain exposure to the ASX miners must also have a favourable outlook towards the energy sector – it worked on Thursday!

- The QFN ETF has a relatively small 0.34% expense ratio, and tracks its benchmark very well, e.g. over the last 3 years the QRE has advanced 6.4% while the Solactive Australian Resources Sector Index has gained 6.9%.

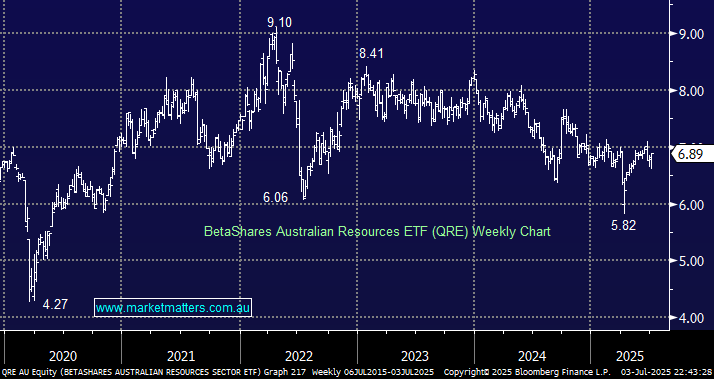

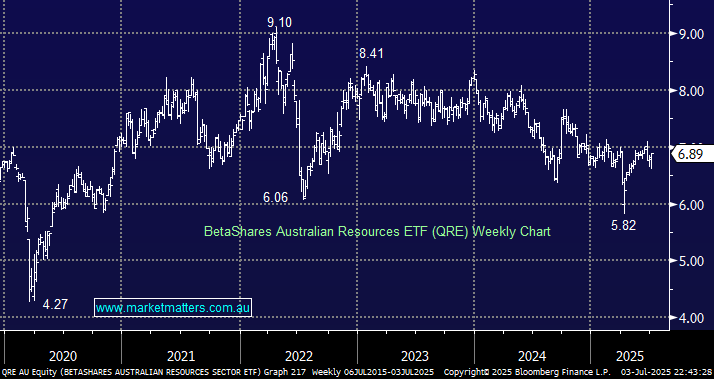

The QRE looks set to follow the MM roadmap into Christmas, testing its 2024 high. We can see it addressing some of its underperformance through the 2H of 2025, similar to Thursday’s stock/sector moves.

- We are bullish on the QRE and initially target a test/break of $8, or 15% higher.