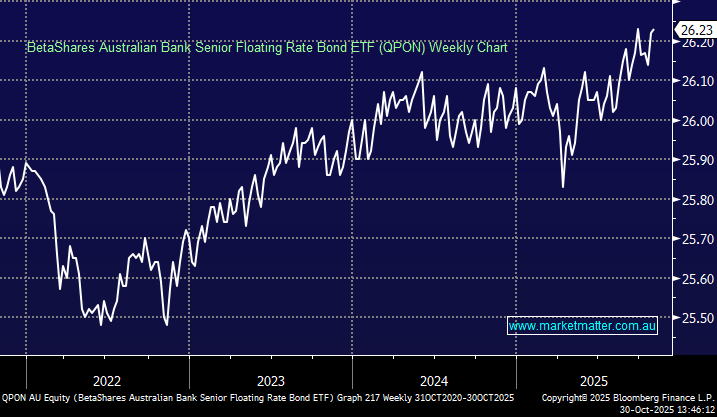

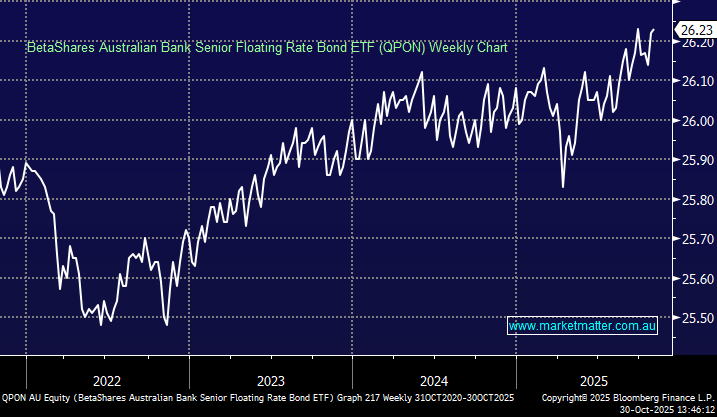

This ETF invests in senior floating-rate bonds issued by Australian banks. A key feature is that if interest rates increase, so too does the income we receive from the floating-rate bonds. Because the underlying bonds have rates that adjust with the benchmark (rather than fixed), the capital-value risk from rate increases is greatly reduced compared with long-duration fixed-rate bonds.

The objective of the fund is to track the Solactive Australian Bank Senior Floating Rate Bond Index, and it has done a good job over the years, gaining +4.52% year-to-date compared to a +4.56% move by the index. The management fee is low at 0.22% for this large ETF, which pays a monthly distribution equating to ~4.6% pa.. The ETF is well adopted and currently has a market cap of $1.8bn. BetaShares sums up the benefits of the QPON ETF, stating the strategy is to generate “regular, attractive income expected to exceed the income paid on cash and short-dated term deposits. If interest rates increase, so too does the income you receive.”

- We like the yield, security and floating nature of this ETF as uncertainty grows toward the direction of interest rates.