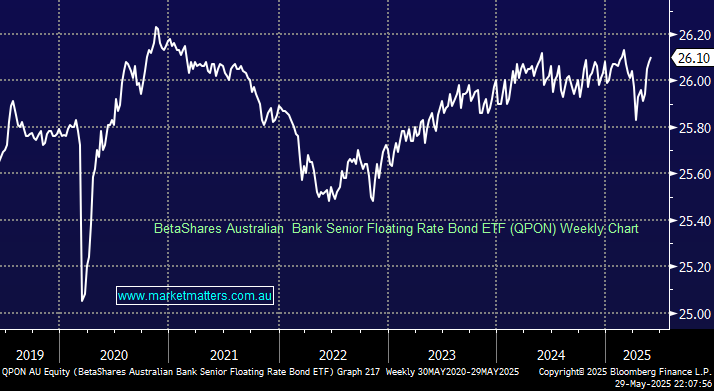

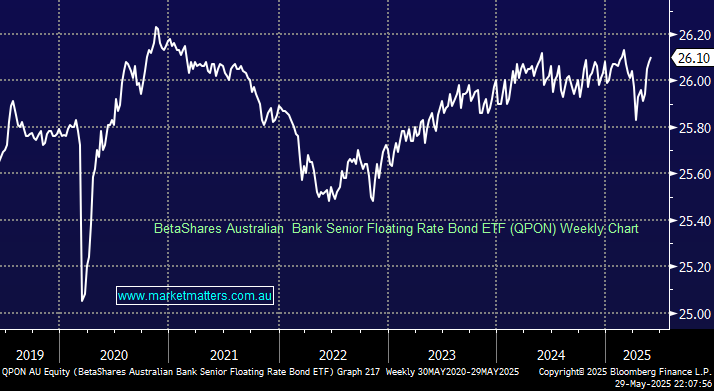

This is the lower risk, lower return security that holds debt that sits one rung higher in the capital structure relative to subordinated debt. Again, this is major bank debt that is floating in nature (rather than fixed). It’s returned 5.12% over the past 12-months, however, while subordinated bank debt will produce 5-6% returns, senior bonds are more like 4-5%.

- Advantage: distributions are paid monthly, which equates to a 5.32% return over the last 12 months. The solid credit quality is backed by Australian major banks, and the expense ratio is a low 0.22%.

- Disadvantage: Yield will fall if/when the RBA cuts interest rates.

We like the QPON ETF as a low risk security that does not make a bet on the direction of interest rates. However, like the BSUB above, we do have a preference for locking in higher interest rates now, so this security is unlikely to feature in any MM portfolio.