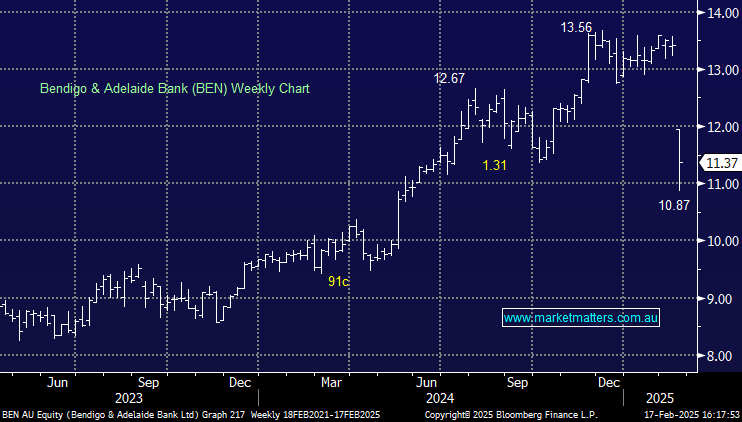

BEN –15.28%: Not often we see a bank down ~18% which was the case early this morning, chalking up the largest one-day drop for the stock since listing back in 1993 with misses across the board but the big concern being a contraction in net interest margins.

- 1H25 cash earnings of $265.2m, ~4-5% below consensus expectations.

- 1H25 Net Interest Margin (NIM) of 1.88% vs. consensus of 1.95%.

- 1H25 Costs of $598m vs. $580m expected, 3% higher than consensus.

The bottom-line miss was cushioned by the reversal of a one-off $10.5m impairment, therefore underlying core earnings were 11-12% below consensus expectations. Above market lending growth is being achieved at the expense of net interest margins. With investment i.e tech spend expected to step up further, we’ll see additional pressure on earnings margins moving forward.

Bendigo was trading at a 2-year forward price-to-earnings of 15.2x, 1x standard deviation higher than its long-term average. As we’ve seen consistently this reporting season, results that don’t significantly outperform consensus are triggering severe unwinding in share prices – we suspect more volatility in this name to come.