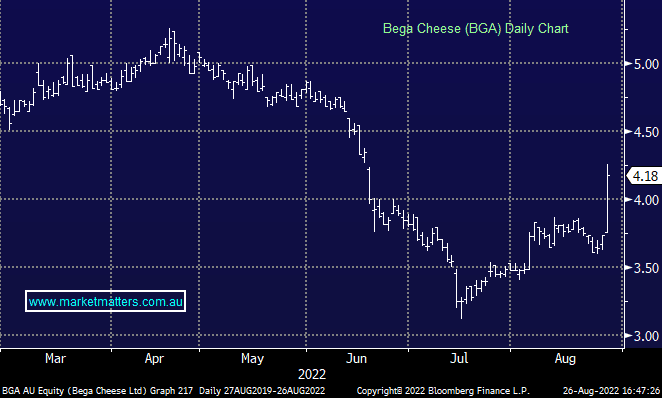

BGA +11.76%%: it was hardly an unblemished report from Bega, however, the dairy products company has performed well despite a number of headwinds facing the business over the last 12 months. EBITDA jumped 27% despite higher mil costs, supply chain disruptions and flooding impacting performance throughout the year, meeting analyst expectations. They also provided EBITDA guidance of $160-190m for FY23, in line with analyst expectations. Investors clearly enjoyed having some firm commentary about the year ahead, despite only meeting expectations, and the result appeared better than feared, helping to push the stock higher today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral BGA

Add To Hit List

Related Q&A

Helia Group (HLI) – Elephant in the Room

Bega Cheese (BGA) – Australia’s Big, Little Food company

Thoughts on HLI Helio

Views on DEG, DYL and HLI

Does MM like Helia Group (HLI)?

Has BGA got its mojo?

Bega (BGA) & Seven Group (SVW) – when to buy?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.