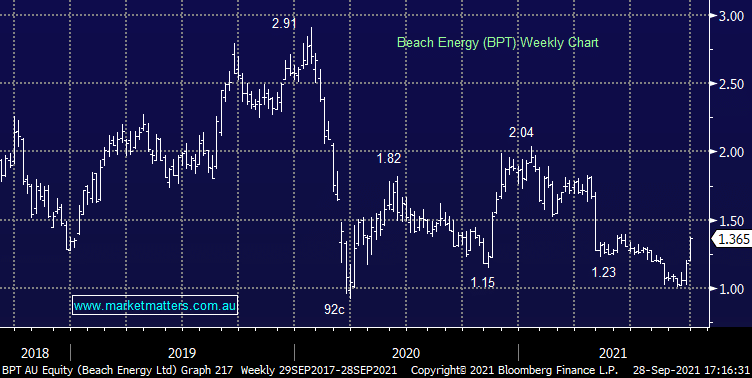

BPT +10.53%: the standout in a weak day today, Beach was helped by surging energy prices as well as a strong showing at their investor day. Beach talking to FY24 production of 28mboe, up from Fy21 25.6mboe. Importantly this target is fully funded and comes from current assets, excluding a number of projects in the pipeline. Gearing is set to peak below 10% in FY22 showing the balance sheet strength, likely the best of their ASX listed peers. They are also guiding to fully offsetting their carbon footprint by 2050 in an effort to alleviate concerns around ESG investment forcing cost of fund higher. It’s been a long while since BPT delivered an optimistic update – it still doesn’t convince us though.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish the sector, preferring STO

Add To Hit List

Related Q&A

Energy Stocks: WDS, STO & BPT

Thoughts on XRO & BPT please

Does MM like BPT medium-term?

Why is BPT underperforming the oil price?

Is Beach (BPT) worth holding?

EOFY ideas

WPL vs BPT, NCM vs OZL

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.