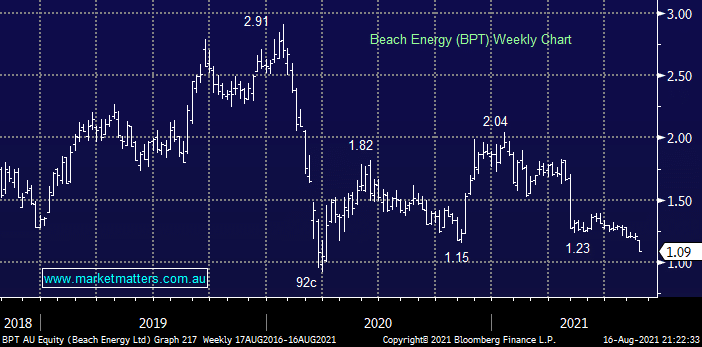

The other stock to fall almost 10% yesterday was BPT, which coincidentally also tumbled -9.9% following its FY21 earnings which disappointingly showed a 37% drop in profits following from a 10% decline in revenue. Oppositely to A2M this is a stock where its increasing number of shorts would have been smiling albeit in this case only a 3.45% exposure. A backdrop of lower production & higher costs means we see nothing to like in BPT fundamentally or technically at this stage, a break of last years painful 92c low feels likely.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is short-term bearish BPT

Add To Hit List

Related Q&A

Energy Stocks: WDS, STO & BPT

Thoughts on XRO & BPT please

Does MM like BPT medium-term?

Why is BPT underperforming the oil price?

Is Beach (BPT) worth holding?

EOFY ideas

WPL vs BPT, NCM vs OZL

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.