Toronto-based Barrick Gold reported higher-than-expected earnings overnight, with production at the top end of the guidance at a time of record prices. Barrick, which, interestingly, this week removed the word gold from its name as it looks to pivot further into copper, benefited from a 40% jump in realised bullion prices, helping it offset a rise in costs and the ongoing suspension of operations in Mali amid a dispute with the military regime. Gold’s surge is helping Barrick raise cash as it looks to pivot harder into copper – sounds like BHP. The company is exiting an Alaskan mining project by selling its 50% stake for $1 billion while signalling more deals on the horizon as it seeks buyers for mines in Africa and North America.

- Revenue for Q1 of $US3.13 billion, up 14% YoY, beat analyst estimates of $3.06 billion.

- EPS of 35c for the first quarter was well above the consensus of 29c.

- Adjusted Ebitda $1.83 billion beat estimate of $1.71 billion.

- Free cash flow of $375 million beat estimates of $145.1 million.

AISC of $US1460-$1560 per ounce is high compared to many Australian names, but it becomes increasingly attractive as the precious metal advances above $US3,000.

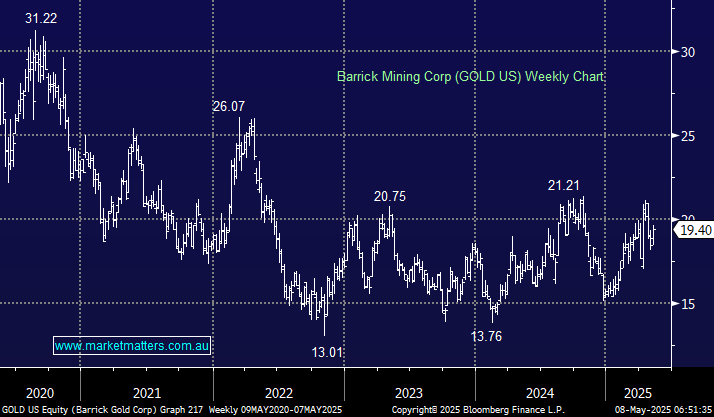

- We can see GOLD testing $US25 through 2025/6: MM is long Barrick (GOLD US) in its International Equities Portfolio.