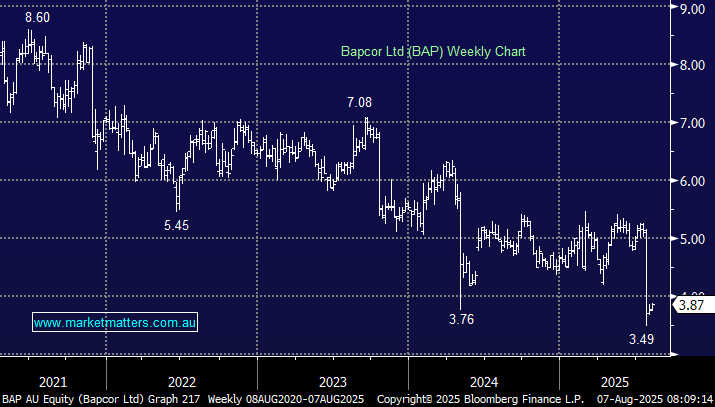

BAP received a $5.40 ($1.83 billion) offer from Bain Capital in mid-2024, which was subsequently rejected by the board saying it undervalued the company, another bunch of directors getting a takeover horribly wrong, a year later and the stock’s down almost 30% from the bid. Since then, operational challenges and competitive pressures, particularly from entrants like Bunnings, have weighed on the stock, driving its share price well below the initial offer level.

Bapcor (BAP) is a leading Australian automotive parts and services company that is feeling Bunnings’ move into the automotive accessories sector, which is eroding BAP’s pricing power and customer footfall. BAP delivered a horrible result last month, which also saw three directors resign. Perhaps they’re embarrassed not to have taken Bains’ money; alternatively, they may feel the rising competition headwinds are making the future feel all too hard. A glance at the BAP chart over the last few years, this is the 4th spike lower by the stock, another red flag to MM.

- We can see BAP potentially catching the eye of suitors, but operationally, we cannot consider BAP, solely hoping for a knight in shining armour.

- There’s a good chance that Bain believes they’ve dodged a bullet and have thrown the BAP file in the bin!