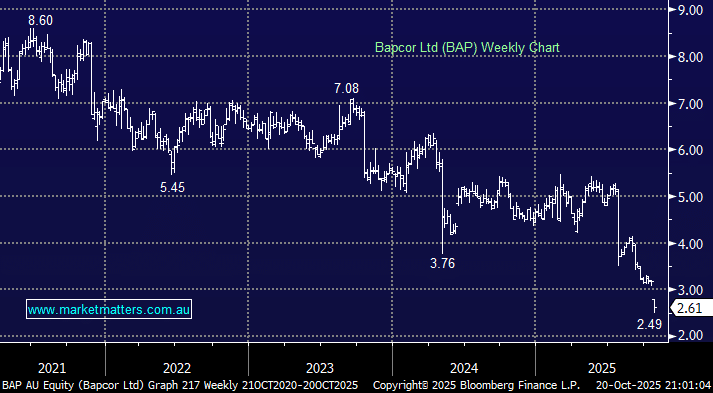

BAP was smacked -17.7% on Monday following a profit downgrade and disclosure of a $12m pre-tax hit tied to operational issues in its trade division. The owner of brands including Autobarn, Burson, Autopro and Midas told investors it expected its statutory net profit for the first half of this financial year to be between $3mn and $7mn because of the operational hit, compared with its previous forecast of between $14 and $18mn. BAP said its internal review discovered accounting errors within its trade division, which it described as “unsatisfactory operational practices”.

Bapcor’s profit engine is its trade distribution network, which benefits from the steady, recurring demand for vehicle servicing and repairs, in theory, a defensive, non-cyclical part of the auto industry. However, a string of issues within the business has led to material underperformance, and it would be a brave buyer to step in here.

- The only reason to consider BAP here is for a takeover. We think there is embedded value in the franchise, and so did BainCapital back in 2024 at $5.40/sh – now with the shares languishing in the mid $2’s, someone could come knocking.