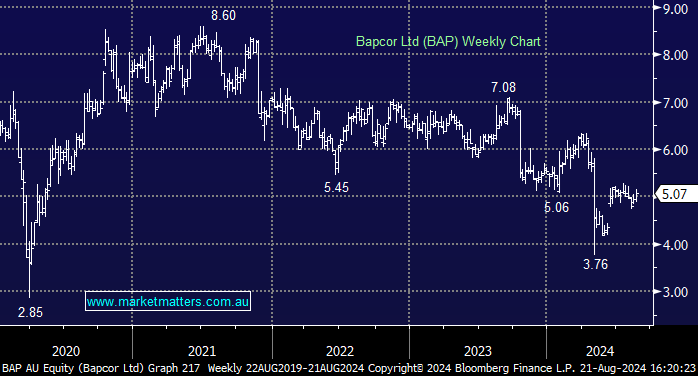

BAP +2.23% edged higher after a difficult period, things are now looking up at BAP with the interim CEO making some positive progress in 4Q24 ready for the new CEO Angus McKay to start tomorrow;

- Revenue of $2.04 billion, +0.8% y/y, estimate $2.05 billion

- Pro forma Ebitda $268.4 million, -10% y/y, and a slight miss to estimates of $274.7 million

- Final dividend per share $0.055

BAP received a takeover from Bain Capital at $5.40 in June, which they subsequently rejected. The new CEO starting tomorrow is very well regarded, most recently running 7-Eleven Australia. The business remains strong, and the industry dynamics are sound. While we’re down 10% on our position in the Emerging Companies portfolio, we view BAP as an undervalued turnaround opportunity.

To start FY25, total revenue for the first 5 weeks was up 7.7% and up 1% on a like for like basis, which is okay.