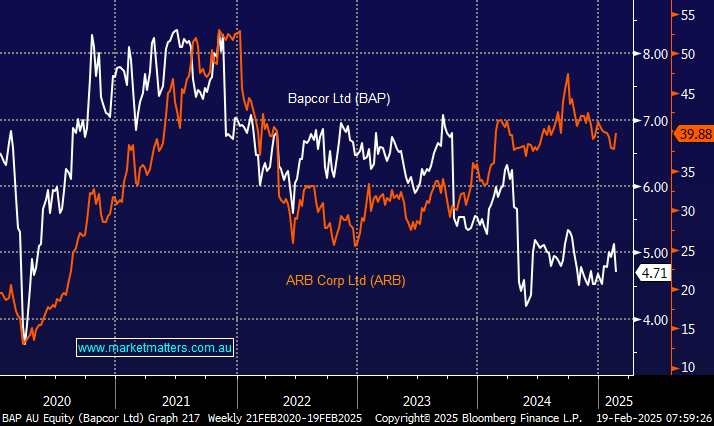

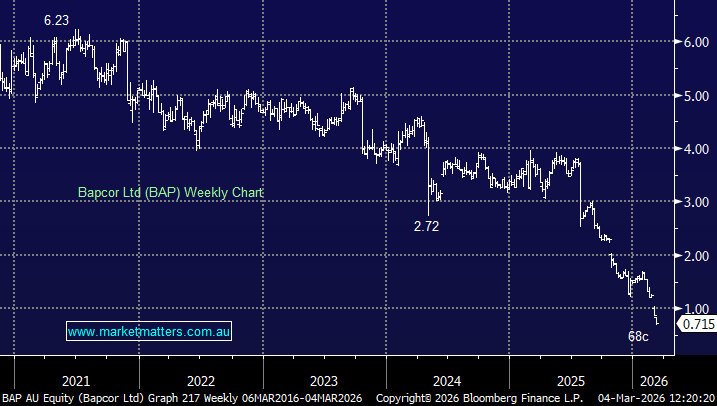

Bapcor is one of the largest distributors of automotive parts and accessories in Australia (& NZ), with a retail network operating under brands Autobarn and Burson Auto Parts, plus a wholesale operation servicing mechanics. Yesterday the CFO George Saoud resigned after a very short stint (appointed July 2024), and not long after the new Executive Chair/CEO took the reins, ex 7-Eleven boss Angus McKay. While Mr Saoud will remain for another 12 months pending a replacement, the market took the news poorly, selling the stock down ~7%. A failed takeover last year, a new Chairman/CEO and now the resignation of the CFO has us questioning our position in the Emerging Companies Portfolio, particularly when green shoots are becoming obvious in ARB Corp (ARB), a more specialised player in the after-market 4WD category.

ARB reported yesterday highlighting tougher conditions in the Australian market remain, which is a negative read-through for Bapcor, though ARB’s US operation is showing good signs of growth. We covered the result (here) along with the dynamics of the car market in Australia last week in a piece on salary packaging and novated leasing operative Smart Group (SIQ) here. The conclusion to both being that we think there are risks for the balance of the year in the Australian car market that could impact new car sales, leasing volumes and aftermarket accessories. ARB’s result yesterday, while not a direct comparison, does strengthen that view.

- We believe ARB has a better niche than BAP, and while it trades on a significantly higher multiple, we believe the quality of the business justifies it, which is aligned with our view towards improving the quality of holdings within the Emerging Companies Portfolio.