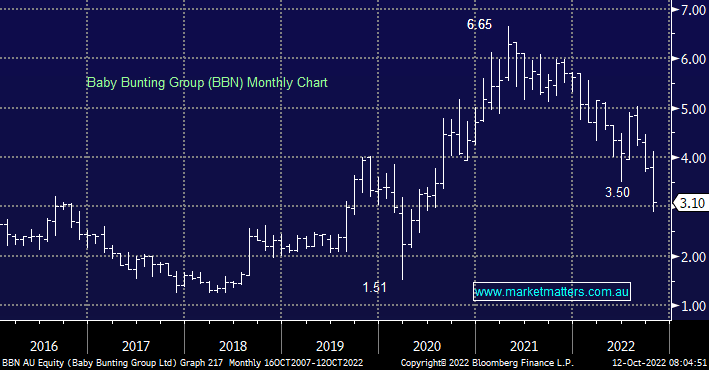

The baby retailer was the worst performer of the ASX300 yesterday with the stock falling to 2-year lows. The latest round of weakness was on the back of commentary at their AGM which showed margins were under pressure. While sales were up 12% for the year to 7 October, Q1 margins had fallen 230bps vs the prior year. The company blamed price competition, freight and FX as the key squeezes on margins. The market was hoping for margins to stay flat at worst in FY23 so we expect to see consensus lowered as analysts revise their numbers this week.

It was particularly disappointing to see freight as a key issue, a problem it seemed that was starting to improve. While we are not keen on Baby Bunting given we think operational momentum is important in this type of market, perhaps yesterday’s move will kick management into gear, and the decline in price does bring this growing retailer back to a more palatable Est PE of 12x for FY23. While the update isn’t a great readthrough for other retailers, it is worth noting that the dynamics of the baby segment aren’t always a great comparison for the broader sector given the intense competition, particularly with the discount department stores. Sales growth, while slowing, is still strong and highlights the underlying strength in the sector which has continued to surprise the market.