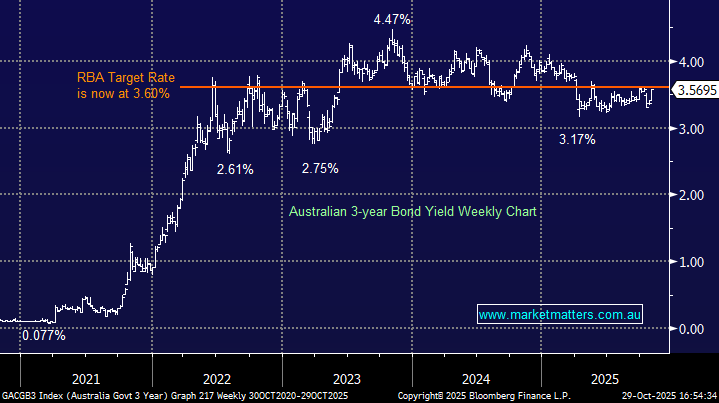

Short-dated bonds were clobbered (yields higher) on Wednesday following the stronger-than-expected quarterly inflation print quashed hopes for a rate cut on Cup Day and probably well into 2026. RBA Governor Michele Bullock certainly had her finger on the pulse on Tuesday when she said that the labour market is “a little tight”, inflation is sticky, and the RBA would require more data before deciding on interest rate cuts. Yesterday’s data is not good news for expectant mortgage holders, with the government’s spending likely to be the point of discussion in the coming weeks. We won’t mention rate hikes yet, but “what comes next” is becoming an increasingly more balanced scenario.

- We see the Australian 3s finely balanced around 3.6%, in line with the RBA Cash Rate. What comes next is feeling like a coin toss as we enter the betting week of Melbourne Cup, which is a lot harder than a 50-50 call!