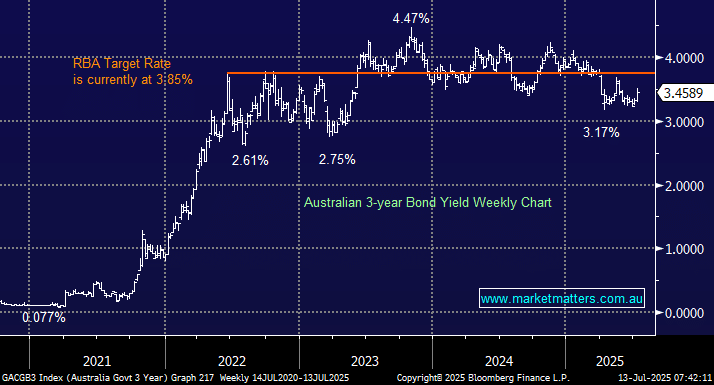

The RBA caught the market off guard last week, delivering no rate cut when the futures market was pricing in a 96% certainty = they were very wrong. Importantly, however, Michele Bullock’s rhetoric was very much along the lines of when, not if, Australian borrowers would receive some relief from the RBA. We feel that the underbelly of the local economy is softening and the RBA will ultimately cut rates twice this year, including one in December, just in time for some Christmas cheer.

- We can see the local 3’s rotating around 3.5% into Christmas; the lower they move, the more supportive it is for rate-sensitive stocks.