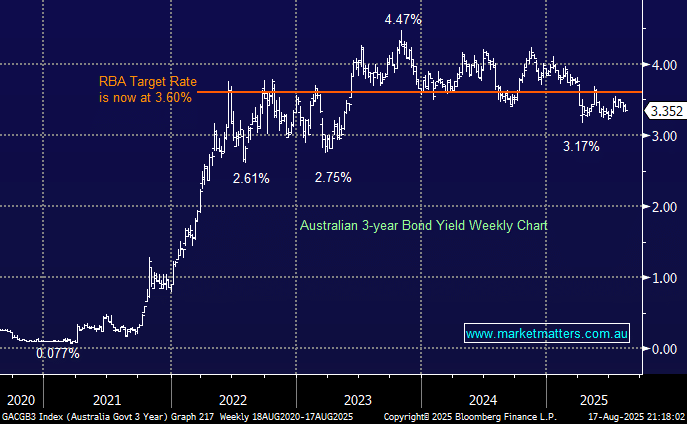

On Tuesday last week, the RBA cut interest rates by 0.25% taking the cash rate to 3.6%, and the market is now pricing in another 0.60% of cuts in the next 12 months i.e. 2-3 further reductions. Based on market pricing, the cash rate will be an even 3% by the end of FY26. The messaging for the RBA was as follows:

- Inflation remains in our 2–3 per cent target range, and they expect inflation to be low and stable over the next couple of years, although it will increase temporarily when some government support measures end.

- Growth in the Australian economy is expected to pick up a little over the next year.

- The unemployment rate is expected to remain steady.

The economic forecast by the RBA appears very supportive of equity markets, although the commentary in the press conference posts the decision does point to various elements of uncertainty. For now, the economic backdrop as presented by the RBA is the “Goldilocks Scenario” that markets had been hoping for.

- We can see the local 3’s trading between 3% and 3.5% into Christmas; the lower they move, the more supportive it is for rate-sensitive stocks.