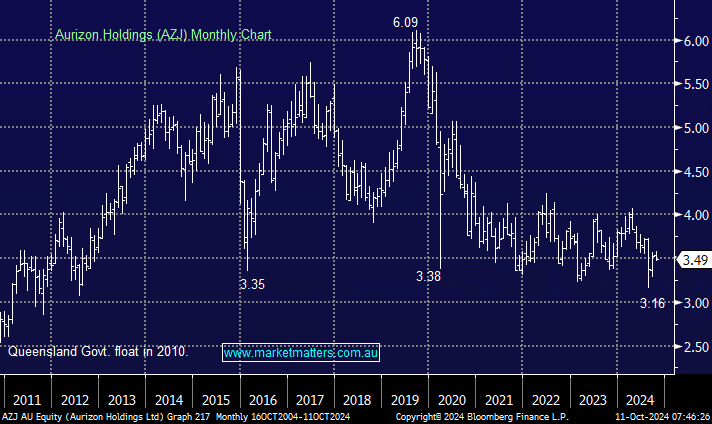

Rail freight operator AZJ’s core businesses are resilient cash generators; however, we think their bulk and container strategies remain unproven. The stock has been a painful “yield-trap’ over recent years, however, as the scale of investment slows down and the balance sheet stabilises after a period of lower payout, AZJ should return more capital to shareholders, which we think will finally please those investors attracted to Aurizon’s yield, which sits at 5.7% part franked for the coming year. The company’s FY24 numbers disappointed investors, but with free cash flows more than 120% higher than last year, management increased the dividend and said it would buy back up to $150 million of its stock – not enough to see buyers meaningfully return over recent weeks.

- We see value reappearing below $3.50, but we also see better alternatives for income elsewhere.