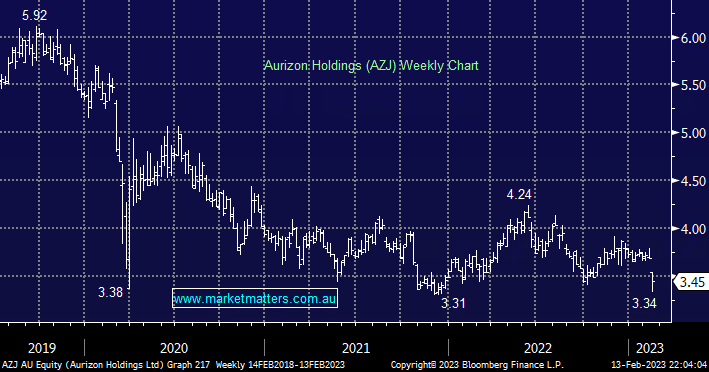

QLD-based rail freight company Aurizon (AZJ) fell -6.5% on Monday after disappointing investors with their 1H23 earnings and downgrade to FY23 guidance, the board blamed the 50% fall in its interim net profit to $130mn on wet weather. However, what would have irked us the most had we been investors was the company had reiterated its profit outlook at its AGM in October, only a few months ago! The other aspect here is around their outlook for dividends versus capital expenditure, with the latter likely to see more of the purse from now, impacting the traditional yield-hungry owners of this stock.

- We don’t like the business’s clear exposure to influences like weather plus it’s now likely to have a register packed with investors believing the stock would deliver a safe fat yield i.e. plenty of sellers into strength.