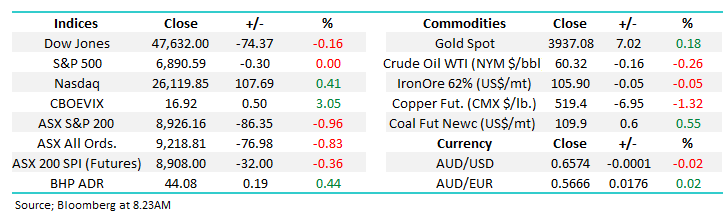

The ASX200 made a new high on Wednesday, before slipping back towards the psychological 9000 level as the local market struggles to fully embrace the bullish lead from the US. Year-to-date, the ASX200 has rallied +10.5% whereas the S&P 500 is up +15.5%. The main action on the Australian bourse remains on the stock and sector level. Last week, the energy sector advanced by +5.4% while the previously high-flying materials names retreated 2%. We’re simply not seeing many days where the market is moving as one.

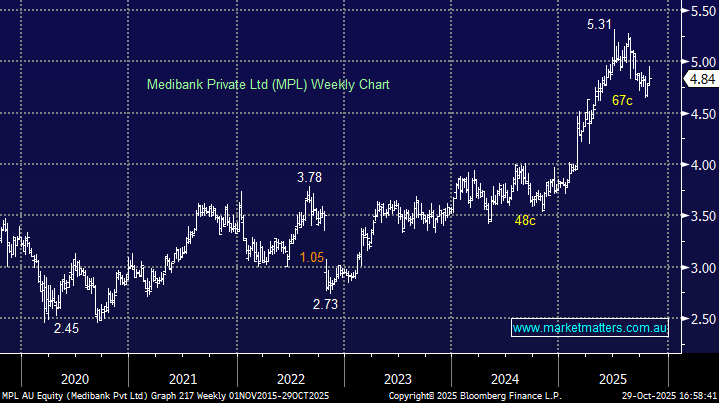

The “Momentum Trade”, which was also often called the “Certainty Trade”, dominated the first half of 2025, pushing up stocks like CBA, JB Hi-Fi, Wesfarmers, QBE, and Pro Medics with the move magnified after the April panic sell-off, but as a group, they’ve noticeably come off the boil in the last quarter. However, as investors search for value in a market that’s often called rich, we believe there’s a good chance this bunch of quality companies will come back into favour with many of their share prices 10-20% lower than where they were in June. If this does occur, it could take the index to a new level of equilibrium.

- The SPI Futures are calling the ASX200 to open up +0.3% this morning, with rate-sensitive stocks likely to be firm.