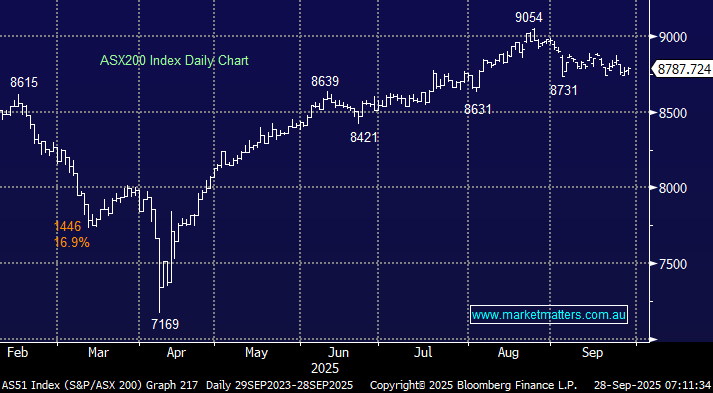

The ASX200 has slipped 2.1% so far in September, which is less than the average for the last decade, for the infamous month although the local index has been weak compared to the US Indices, with the S&P 500 posting new highs. Arguably, the market’s performance has been even more disappointing when we consider the recent strong performance from the local miners. We talked about the volatility that October often delivers earlier today, and when we look at the rest of 2025 so far this year, it hasn’t danced too much out of step from a seasonality perspective, but it has been significantly more volatile than the norm, both into and out of April’s “Liberation Day”. If October does follow the trend of the year, we’re set for some fun and games with MM keen to buy weakness over the coming weeks if it does materialise.

- On Saturday morning, the SPI Futures were calling the ASX200 to open up +0.2% this morning, back around the 8800 level, again!